When what you don’t know hurts your conversion rates

Invisible problems of growth-stage startups that create friction, make it hard to stand out, and slow you down

What you want your website or landing page to do: Bring. In. Prospects.

But unless you’re this guy…

… you can’t scale effectively without answering these questions:

“What do we say to our audience?”

“How can we position ourselves in a way that makes sense to our audience?”

“How do we differentiate ourselves from other solutions?”

“How can we stand out — and present our product in a way that makes our prospects want to find out more?”

“How can we persuade our prospects to reach out?”

And very often, as I start answering these questions for my clients, this is where we uncover those potential issues that would otherwise have stayed invisible.

In this blog post: examples of invisible problems that may be slowing down your growth — and ways to overcome them.

“What do we say to our audience?”

Duh! “Buy our product!”

Sure. Yes. And also…

It depends.

More specifically, it depends on:

Level of sophistication

Beliefs about the industry

Beliefs about available solutions

Beliefs about themselves

What they know (or think they know) about your competitors

What they know (or think they know) about your product

What (specifically) triggers their search for a new solution

Without knowing all that, your copy will be based on assumptions about what your audience needs to hear, which tend to be *really* skewed by our biases.

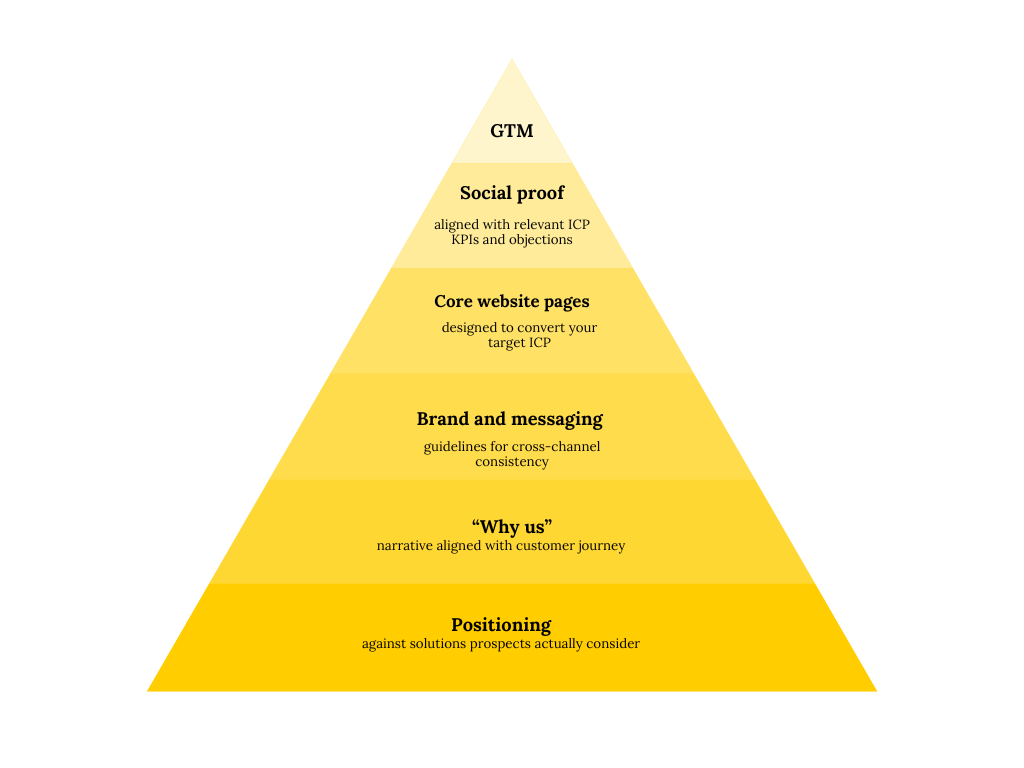

Narrative → what's happening in the external world

— Pe:p Laja 🇺🇦 (@peeplaja) April 29, 2022

↓

POV → our opinion on what to do about it

↓

Positioning → which problem are we solving for whom (that cares a lot about it)

↓

Messaging → key things we want to communicate to the target buyer

↓

Copy → how to say that

For example, if you were selling to people just like you during the early-stage days and want to attract a new audience, assuming that they’ll respond to the same messaging is dangerous.

Instead, assume that your messaging will need to be adapted to fit the new audience (which has different concerns, goals, and objections), unless research shows otherwise.

A big takeaway is our best customers are those most *not like me* (in terms of what they do/their business model/use case).

— Brian Casel (@CasJam) June 3, 2022

Its both challenging and exciting at the same time.

Harder to naturally speak their language. But that's where the interviews become especially helpful!

Another example of invisible problems at this point is centering your messaging around the FAQs that come up during sales calls.

Invisible problem here: depending on your prospects’ buyer journey, these questions may only be relevant to the most-aware prospects crossing off last items from their “Must have to move forward” list.

If your website needs to attract solution-aware prospects and convince them to explore the product further, then their questions, concerns, and needs will be very different. Addressing *only* the last-on-the-list questions would mean leaving all the other questions unanswered (and lead to a high bounce rate, low time on page, and low conversion rates).

Figuring out what you should really be saying to your audience: an example

One example from a project I worked on highlights assumptions about what 2 different ICPs want from a product.

Based on the questions that prospects asked during demo calls, the sales team had reasons to believe that one of the ICPs was deadline-driven and focused exclusively on short-term goals.

Digging into jobs-to-be-done and desired outcomes via a survey and follow-up interviews showed that those 2 ICP groups were not as different as their demo questions led us to believe (and, interestingly, the desired outcomes also did not correlate with the assumptions based on the most common objection).

What this affected:

High-level messaging hierarchy for the homepage…

Structuring use case pages based on secondary concerns and hesitations…

Connecting case studies and selecting customer quotes based on the most desirable outcomes…

…so that the website conversation starts at the website visitors’ stage of awareness and moves the to the next stage, so that they can be confident that the product will help them achieve both their long-term and short-term goals (reducing churn and helping attract best-fit customers).

“How can we position ourselves in a way that makes sense to our audience?”

One of the most common challenges prospects share with me is “It looks like our prospects don’t really get what we do until they see our product during the demo.” Another one is “Our ‘Aha!’ moment only comes after onboarding.”

Both of those mean that the website — or the ad funnels — are likely voice-of-customer-less, and, by extension, “me-focused.”

I blame the “Create a category” and “Find your blue ocean” fads.

It is extremely tempting to neatly side-step positioning against competitors and alternatives and go for it — but the danger here is that your ideal customers just won’t get what it is you’re helping them achieve (and that’s even before we get into the conversation around what it takes to actually make the category stick if you’re not an established company with a sizeable marketing budget).

Not to mention that sometimes “this is a totally new thing” can sound somewhat (or really, really) implausible:

Figuring out positioning: an example

In one of my past projects, there was a mismatch between the prospects my customer was targeting and the prospects they had been attracting via their website.

Unfortunately, when copy attracts the ‘wrong’ prospects, it also repels the ‘right’ prospects. By focusing our research and discovery phase on asking existing customers to describe the product, we were able to find a common theme and the voice-of-customer phrases that also described the product itself in a less ambiguous (and more specific) way.

In addition to the category creation play, voice-of-customer research also helps avoid mental shortcut biases (see also: the curse of knowledge).

As a side note: this is why I love messaging testing so much — it helps uncover just where the copy that makes sense to everyone on the team doesn’t make sense to people on the outside.

Valuable when you just can’t bring yourself to kill your darlings… until you realize they confuse everyone else.

“How do we differentiate ourselves from other solutions?”

Another question that messaging panels help answer is “What do we need to say to differentiate ourselves from other solutions?”

Yes. Positioning can be a whole separate conversation (as well as messaging, personas, and buyer journeys). But at some point the rubber’s going to hit the road: in your ad funnels, email outreach, or on your website.

And when that happens… your prospects will be considering:

Not doing anything

Going with an alternative solution (we’re done with PPC - time to grow organic traffic!)

Your competitors

"Ignore the competition"

— 🤔 Josh Garofalo (@swaycopy) May 5, 2022

☝️= Terrible advice.

Watching the competition doesn't have to mean copying the competition.

Instead, watch the competition to identify valuable unoccupied territory.

Move in. Claim it without a fight.

Problem-aware: the old way isn't working — what should I do instead?

Here’s a great example of positioning content: SparkToro’s old way isn’t working — what you should do instead.

Solution-aware: I could use Airtable… or should I go with that other thing instead?

And this is where it gets interesting.

Pretending that there are no competitors is not an option.

But how do you stand out in a meaningful way (that doesn’t involve fluffy claims, we-do-this-too copy, or relying on competitor research to find your own message)?

The easiest way to find that differentiator — in my experience — is to talk to your customers. After all, they chose your solution for a reason.

That said, for companies that previously relied on referrals, this may not be the way to go. Alternatively, I’ve relied on review mining and forum mining to find meaningful differentiators, aka the things that prospects actually care about.

Especially if you have established competitors, finding gaps and opportunities to differentiate your product is possible - especially if you use additional research methods to evaluate them, and then niche down and get specific.

Don't copy the big names.

— Wynter (@wynter_com) June 16, 2022

Big brands have the advantage that their reputation precedes them. They can get away with fuzzier messaging.

Shopify or Amazon, or Salesforce don't need to explain what they are, they can trade crisp messaging for fuzzy feelings and get away with it. pic.twitter.com/SiwaaCDF16

Figuring out how to go from “benefits” to “how we’re different”

When companies rely strictly on competitor research and analyzing competitors’ messaging, it’s very easy to end up with the world’s most generic website copy.

Without VoC research and/or creating feedback loops, it’s really hard to escape the “they all sound the same” trap — and focus on the differentiators that prospects really care about, instead of focusing on superfluous differentiators.

For startups, being able to show that their product is different is a meaningful way is important: established brands have more credibility, more case studies and customer logos. Startups need to prove that they are solving a specific problem much better — and in a different way (or for a previously underserved niche).

Compete with:

— 🤔 Josh Garofalo (@swaycopy) April 19, 2022

• INFERIOR products on FEATURES

• SIMILAR products on BRAND

• SUPERIOR products on POSITIONING

Non-product differentiators could also be - partner ecosystem, community (or skills availability), professional services, industry experience/expertise, company viability, etc. - there is a LONG list. https://t.co/cN9cWjpm18

— April Dunford (@aprildunford) June 18, 2022

And sometimes, they also need to overcome initial skepticism or objections (anything from “It’s not a priority for us” to “We don’t actually have this problem”).

In one of my projects, some target market segments did not believe that there was a problem to solve - or doubted that the problem was serious enough to be solved. By restructuring the page and focusing on proof points aligned with the problem-aware stage (and agitating the cost of not acting) we were able to increase free trial signups by 16%.

“How can we stand out — and present our product in a way that makes our prospects want to find out more?”

“The future of…” is not it. But you already know that.

But what should we say instead — that fits the hero section, speaks to our ICPs, and helps us differentiate our product from every other product out there?

That’s hard.

And, the annoying part is that the answer is going to change as your startup grows and changes.

But being able to answer the question “Who are you and why should I care?” is the difference between moving your prospects from solution-aware to product-aware to demo and having a high bounce rate because the copy doesn’t make sense.

Sometimes, all you need to focus on is differentiation (see above).

But at times, you are building a product that challenges the status quo — and needs to have a compelling big idea that helps prospects see the new opportunities they hadn’t considered before.

You may have seen this approach in slide decks (shoutout to the amazing Sarah Mackinnon for sharing this with me) — and it works for web copy and landing pages as well.

This argument does not have to take up 60% of your homepage — but ignoring those objections, just as ignoring the fact that your product has competitors, is not going to improve your conversion rates.

If your prospects don’t believe in the future you’re presenting — or that they can thrive in that future — they will not consider your product as one of possible solutions. And if they don’t see the future because your hero section is too vague, they’re less likely to keep reading.

Figuring out how to stand out and encourage prospects to find out more

While identifying a low scroll depth and a high bounce rate is a good start, it doesn’t answer the question “What is not working?”

In cases when copy is generic (but benefit-oriented), a good way to figure out what’s missing and why is running a messaging test. In a website copy project that was targeting 3 separate ICPs, running Wynter messaging panels helped us understand what was missing on the page, what was not resonating, and which sections of the page made prospects go “Tell me more!” Having access to that info provided a blueprint for optimizing the copy.

“How can we persuade our prospects to reach out (or sign up for a trial)?”

So… This is where the real fun starts. Using data from points 1-4, so that the copy is informed by all of these:

Stage of awareness

Level of sophistication

Beliefs about the industry

Beliefs about available solutions

Beliefs about themselves

Desired outcomes and JTBD

What viewers know (or think they know) about your competitors

What they know (or think they know) about your product

PLUS, messaging hierarchy that makes sense for the audience — and an offer that is optimized to encourage prospects to reach out (not to forget about providing the information they need to make a decision to act — especially if one of the steps in their buyer journey is creating a shortlist of products to consider).

PLUS, making sure that the hero section(s) are not vague in a way that’ll make visitors bounce.

AND, making sure that it’s clear:

Sometimes, we won’t have all that information available — or won’t need that information because the project scope is more narrow (for example, a landing page ad traffic funnel). But even then, getting the research done can mean a higher-than-average conversion rate — or a 50% opt-in into a sales sequence.

All those rage clicks flagged in Hotjar may turn out to be a UX issue, not a copy / messaging issue.

— Ekaterina Howard (@katya_howard) May 19, 2022

Or it could be that your current website doesn’t work - or attracts the wrong type of prospects.#messagingforgrowth #b2bsaas #startups #research #growth

But in an ideal world, you have a research system that means that you never have to guess why a page is not converting, and can easily stay on top of changes in ICPs’ behavior, appearance of new competitors, or marketing to new segments of customers:

There are 3 classic scenarios for SaaS customer research:

— Marc Thomas (@iammarcthomas) June 24, 2022

1. Companies aren't doing it at all or don't have a strategic approach (extremely common)

2. Hire a market research agency to 'take care of it'

3. Some poor marketer is tasked with doing it all but generally unsupported

I help B2B SaaS startup founders and marketers get more traction with research-driven conversion copy — without slowing down their growth initiatives.

Hire me for:

Customer research to ramp up your growth

Website audit to find & fix conversion blockers

Day rates to optimize your landing pages, web copy, or email sequences for more clicks and signups

![[S2E6] How to build a content ecosystem to convert and support users](https://images.squarespace-cdn.com/content/v1/510fa084e4b060f86e73735a/1750284561646-AA8WDFHRFZ32GQO5GI51/S2E6+Podcast+Cover+visuals.png)

![[S2E5] Practical Guide to Wynter Messaging Tests](https://images.squarespace-cdn.com/content/v1/510fa084e4b060f86e73735a/1747226672649-1AU6KQD4RIGSNSIIQLGW/Solo_episode_cover.png)

![[S2E4] How to: message testing on a budget](https://images.squarespace-cdn.com/content/v1/510fa084e4b060f86e73735a/1744221834434-TF0URFQBJNYQPPMKQNHK/alex_atkins_cover_image.png)

![[S2E3] How to: positioning](https://images.squarespace-cdn.com/content/v1/510fa084e4b060f86e73735a/1742493000706-NG82ZT4YFEM2AFCDG03N/S2E3_Josh+Garofalo_COver+Image.png)

![[S2E2] How to find winning angles for your competitor pages](https://images.squarespace-cdn.com/content/v1/510fa084e4b060f86e73735a/1740671619617-YYWZU1UAQOHY3RDFNTIC/YDGW_S2E2.png)